IRS Forms

IRS forms are crucial documents used by the Internal Revenue Service in the United States to gather specific information from taxpayers, covering a broad spectrum of financial transactions, reporting requirements, and taxpayer obligations. We understand the complexity of handling these forms and have developed a seamless solution to simplify the data extraction process.

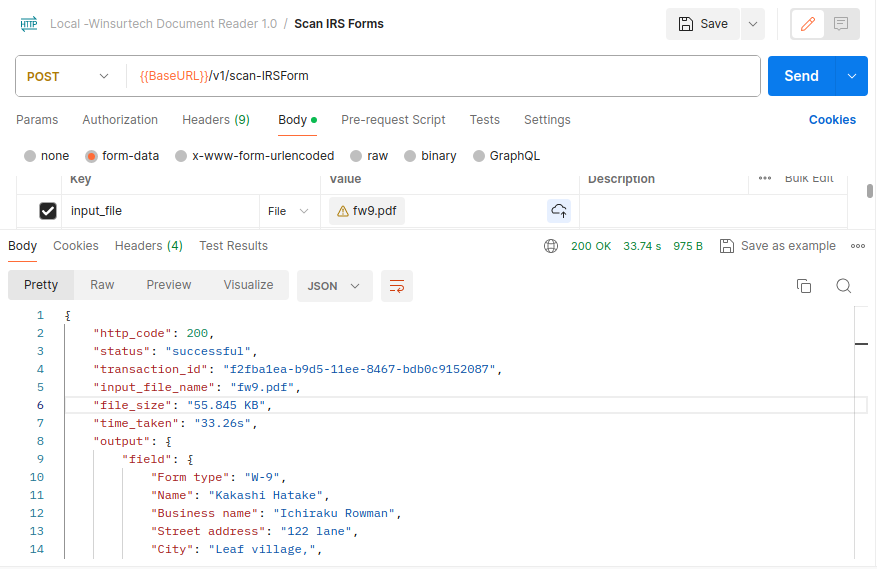

Our REST API enables automatic identification and precise capture of crucial information from IRS forms ensuring an efficient extraction process. Our ready-to-use REST APIs seamlessly integrate with existing systems, allowing easy incorporation into workflows without complex setups. The extracted data is presented in a structured JSON format for convenient interpretation and usability.

The resulting JSON response is a valuable resource that can be utilized for various purposes, including integration with other systems, comprehensive data analysis, and efficient record-keeping. This versatility allows you to make the most of the extracted data, tailoring it to meet your specific needs.

Discover the power of seamless IRS form data extraction with our Azure AI-powered solutions. Transform your document processing workflows and elevate your efficiency to new heights. Get started with the Winsurtech DocReader REST API today!

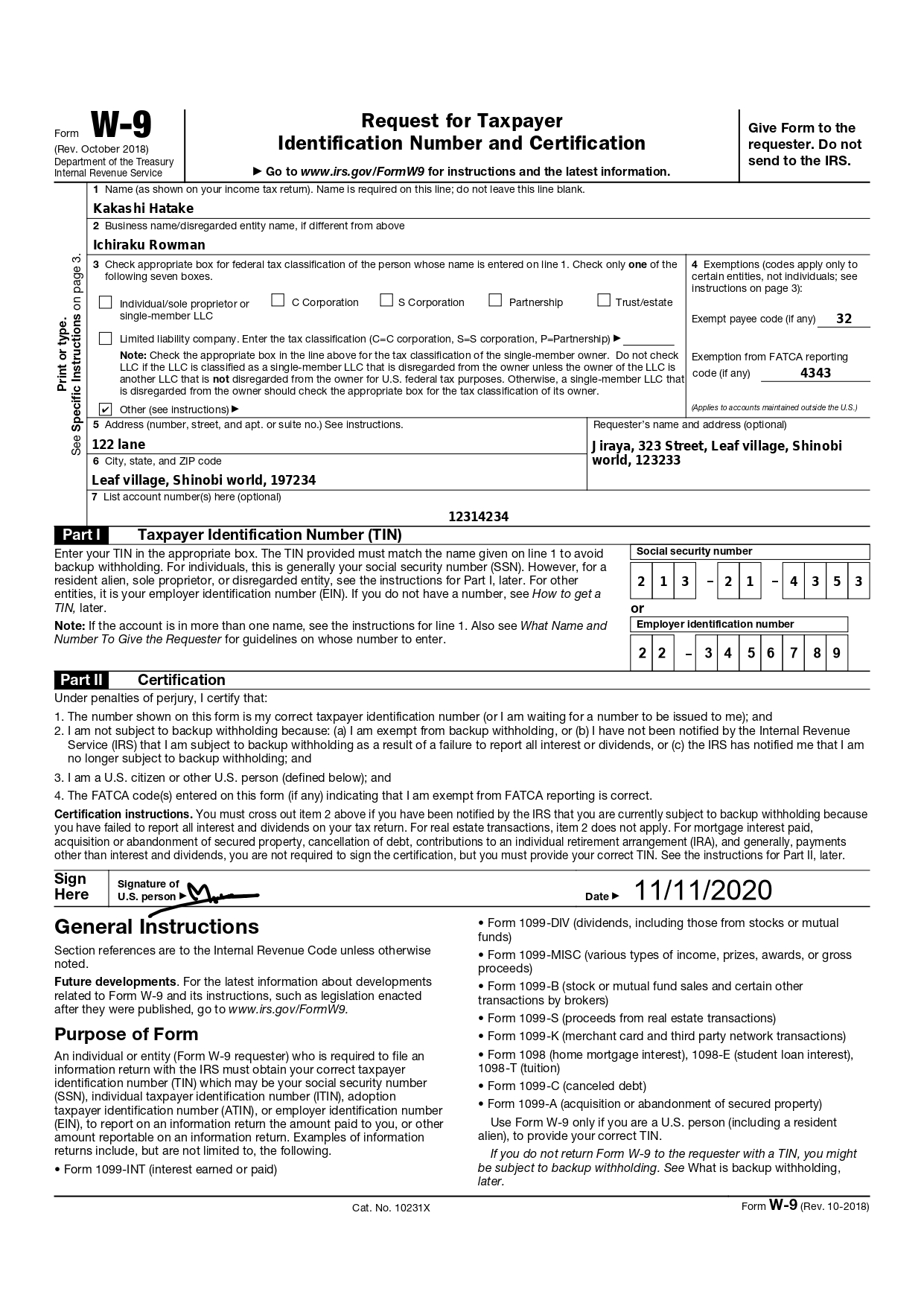

FIG: Sample Input

| Form Name | Form Description |

| IRS W-2 | IRS W-2 form is filled for reporting wages and tax information of employees. |

| IRS W-2G | IRS W-2G form is filled for reporting certain gambling winnings to the IRS. |

| IRS W-4 | IRS W-4 form is filled for employee withholding allowance certificate. |

| IRS W-7 | IRS W-7 form is filled for application for IRS individual taxpayer identification number (ITIN). |

| IRS W-9 | IRS W-9 form is filled for request for taxpayer identification number and certification. |

| IRS 4506-T | IRS 4506-T form is filled for request for transcript of tax return. |

| IRS SS-4 | IRS SS-4 form is filled for application for employer identification number (EIN). |

| IRS W-8BEN | IRS W-8BEN form is filled for certificate of foreign status of beneficial owner for United States tax withholding and reporting (individuals). |

| IRS W-8ECI | IRS W-8ECI form is filled for certificate of foreign person's claim that income is effectively connected with the conduct of a trade or business in the United States. |

| IRS 4868 | IRS 4868 is filled out to request an automatic extension of time to file a U.S. individual income tax return. |

| IRS W-3 | IRS W-3 is filled out to transmit paper Forms W-2 to the Social Security Administration. |

| IRS 8822 | IRS 8822 form is filled to notify the IRS of a change in address for an individual or business. |

| IRS W-11 | IRS W-11 form is filled out by individuals to certify their foreign status and claim treaty benefits. |

| IRS W-10 | IRS W-10 form is filled out by individuals to provide their taxpayer identification number to a financial institution. |

| IRS 8233 | IRS Form 8233 is filled out by nonresident aliens to claim exemption from withholding tax on personal service income. |

| IRS W-12 | IRS Form W-12 is filled out by tax return preparers to apply for or renew a Preparer Tax Identification Number (PTIN). |

| IRS 5498-SA | IRS Form 5498-SA is filled out by trustees or custodians to report contributions and fair market value of HSAs, Archer MSAs, or Medicare Advantage MSAs. |

| IRS 5498 | IRS Form 5498 is filled out by trustees or issuers to report contributions, rollovers, and fair market value of an individual retirement arrangement (IRA). |

| IRS 5498-ESA | IRS 5498-ESA is used to report contributions to Coverdell Education Savings Accounts (ESAs) and to provide information on the account balance and rollovers. |

| IRS 1042-S | IRS 1042-S is used to report income that is subject to withholding under the Internal Revenue Code, including income paid to foreign persons. |

| IRS 945 | IRS 945 is used to report annual income tax withheld from nonpayroll payments, including pensions, annuities, and gambling winnings. |

| IRS 940 | IRS 940 is used to report federal unemployment (FUTA) tax for the year, including details on wages and the tax due. |

| IRS 1120-H | IRS 1120-H is used by homeowners associations to report income, deductions, and tax liability under the Internal Revenue Code. |

| IRS 1099-LTC | IRS 1099-LTC is used to report payments under a long-term care insurance contract and certain accelerated death benefits. |

| IRS 1099-MISC | IRS 1099-MISC is used to report miscellaneous income including rents, royalties, and nonemployee compensation. |

| IRS 1099-NEC | IRS 1099-NEC is used to report nonemployee compensation such as payments to independent contractors. |

| IRS 1099-OID | IRS 1099-OID is used to report original issue discount income to taxpayers and the IRS. |

| IRS 1099-PATR | IRS Form 1099-PATR is used to report taxable distributions received from cooperatives. |

| IRS 1099-Q | IRS Form 1099-Q is used to report distributions from qualified education programs. |

| IRS 1099-G | IRS Form 1099-G reports government payments like tax refunds, unemployment benefits, or agricultural subsidies to taxpayers for their records. |

| IRS 1099-B | IRS Form 1099-B reports proceeds from broker transactions, such as stock sales, to help taxpayers calculate capital gains or losses. |

| IRS 1099-C | IRS Form 1099-C reports canceled or forgiven debts of $600 or more, which may be taxable as income to the recipient. |

| IRS 1099-DIV | IRS Form 1099-DIV reports dividends and distributions from investments, such as stocks or mutual funds, for tax purposes. |

| IRS 1099-INT | IRS Form 1099-INT reports interest income earned from investments, such as savings accounts or bonds, for tax filing purposes. |

Connect with us today or click here to subscribe to transform your data extraction processes.